Your Credit Score 101

People with perfect credit scores have 3 key traits in common, Experian reports. While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one.

What Is A Good Credit Score? Go Car Credit

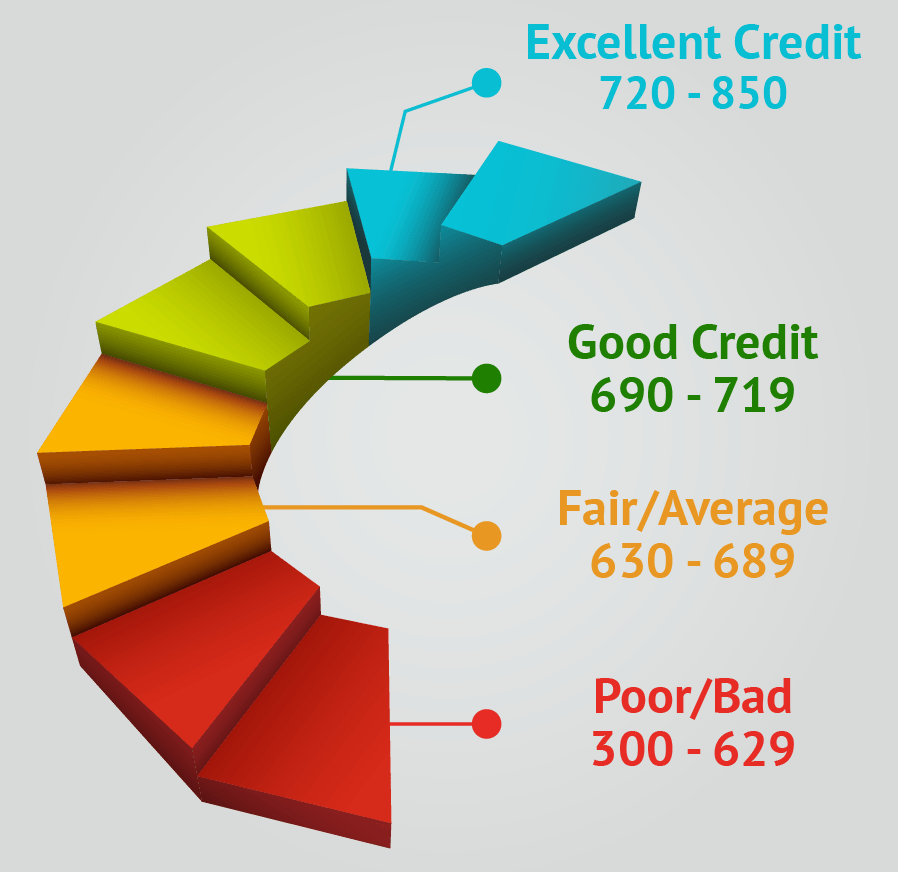

A score of 720 or higher is generally considered excellent credit. A score of 690 to 719 is considered good credit. Scores of 630 to 689 are fair credit. And scores of 629 or below are bad credit.

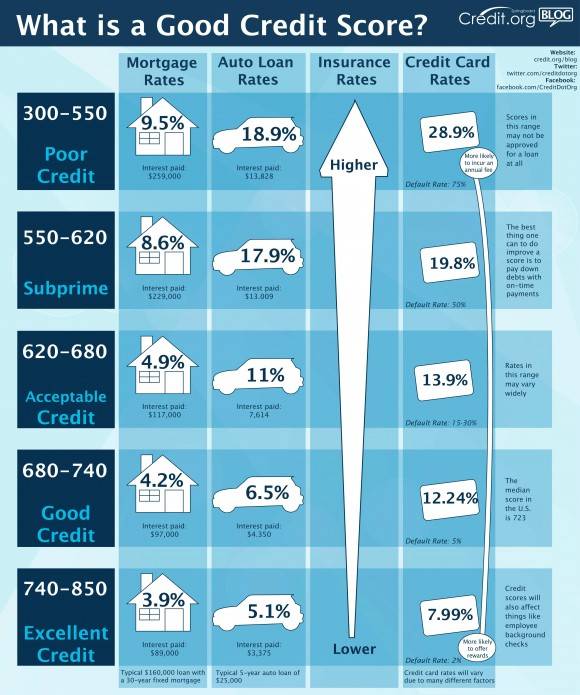

What is a good credit score? [Infographic]

Silent. 12.8%. "Good" score range identified based on 2023 Credit Karma data. With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms. You might also be approved for credit cards with valuable sign-up bonuses and attractive rewards programs.

How to Improve your Credit Score

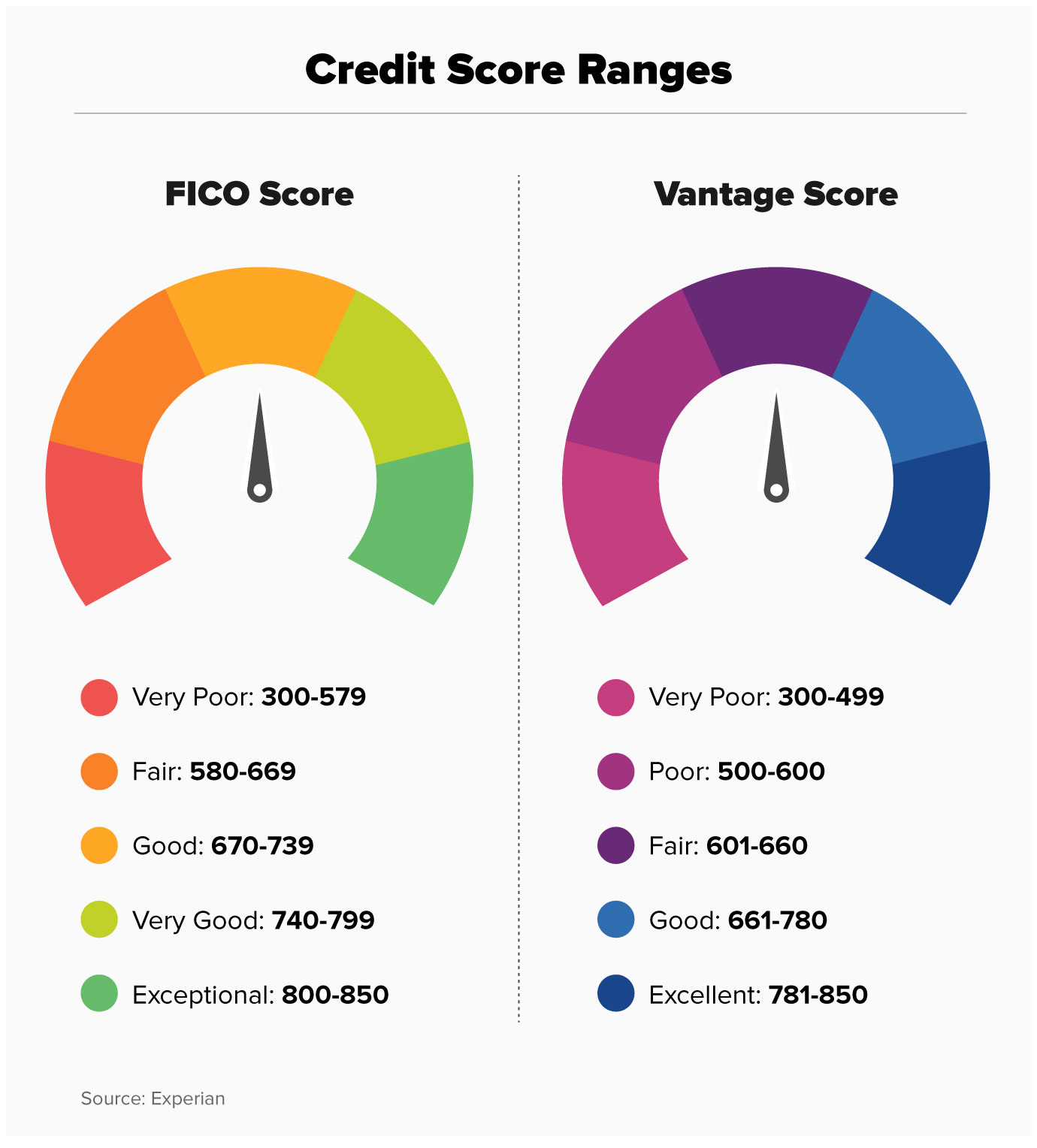

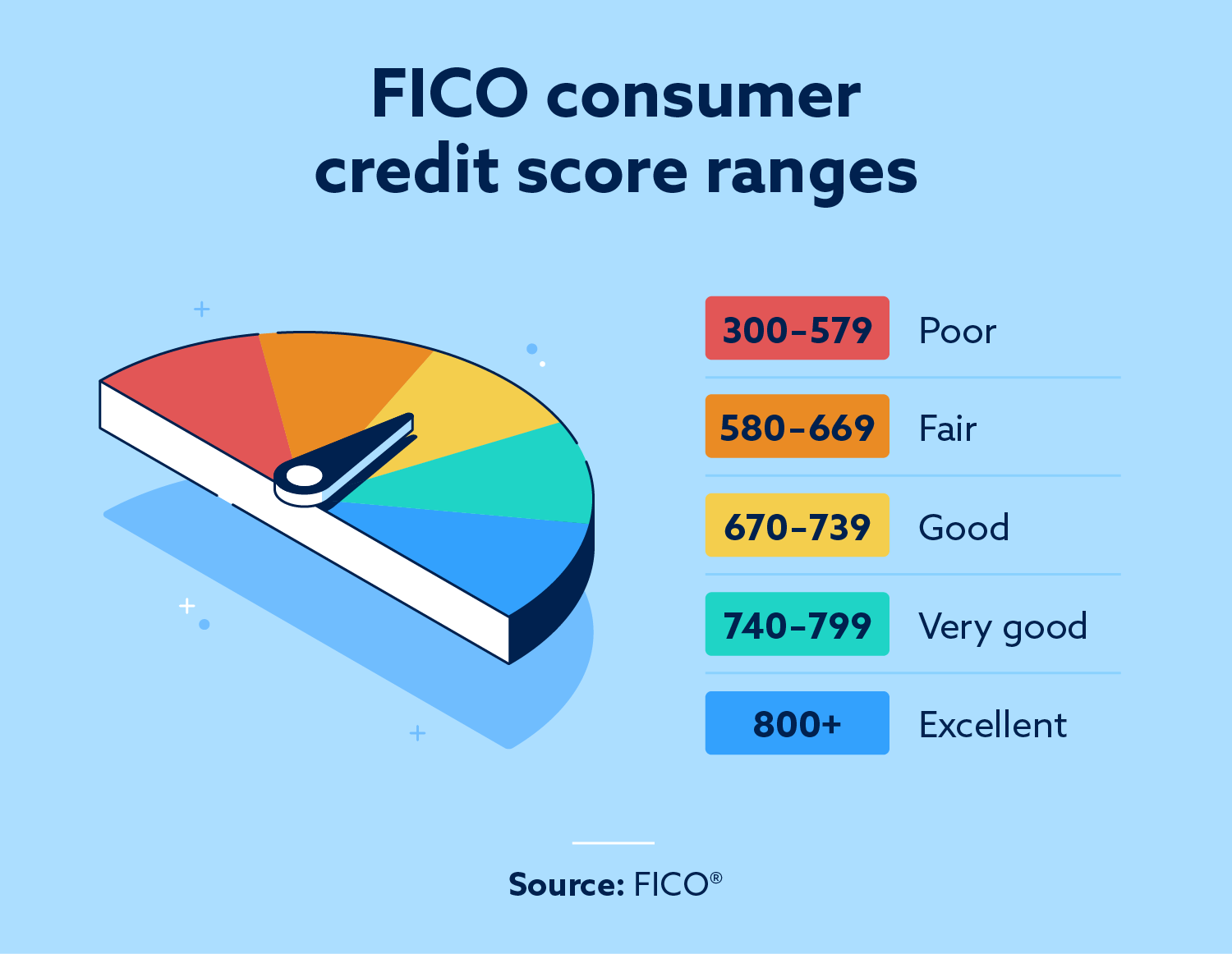

For FICO, credit scores from 670 to 739 are considered to be good, 740 to 799 are very good and above 800 are exceptional. VantageScore has a slightly different breakdown where credit scores between 601 and 660 are considered near prime, scores between 661 and 780 are considered prime, and scores 781 and above are considered super prime.

What Credit Score Is Used for Car Loans? Self. Credit Builder.

Near prime (620 to 659) 17.95%. Subprime (580 to 619) 15.20%. Deep subprime (579 or less) 1.98%. The lower your credit score, the lower your chances of you being able to buy a car. If your credit.

What Is a Good Credit Score? Experian

A good credit score is 690 to 719 on the 300-850 scale used by the main scoring companies, FICO and VantageScore.. Equifax and Experian.. A desirable car loan or lease. If your credit score.

What is a Good Credit Score Range? MyBankTracker

A credit score is a 3-digit number between 300 and 850. The higher, the better. The FICO ® credit score is the most commonly used credit measure, but there are other scoring models, including the VantageScore ®. A good credit score is between 670 and 739 on the FICO scale, and between 661 and 780 on the VantageScore scale.

What Credit Score Do You Need to Get a Car Loan?

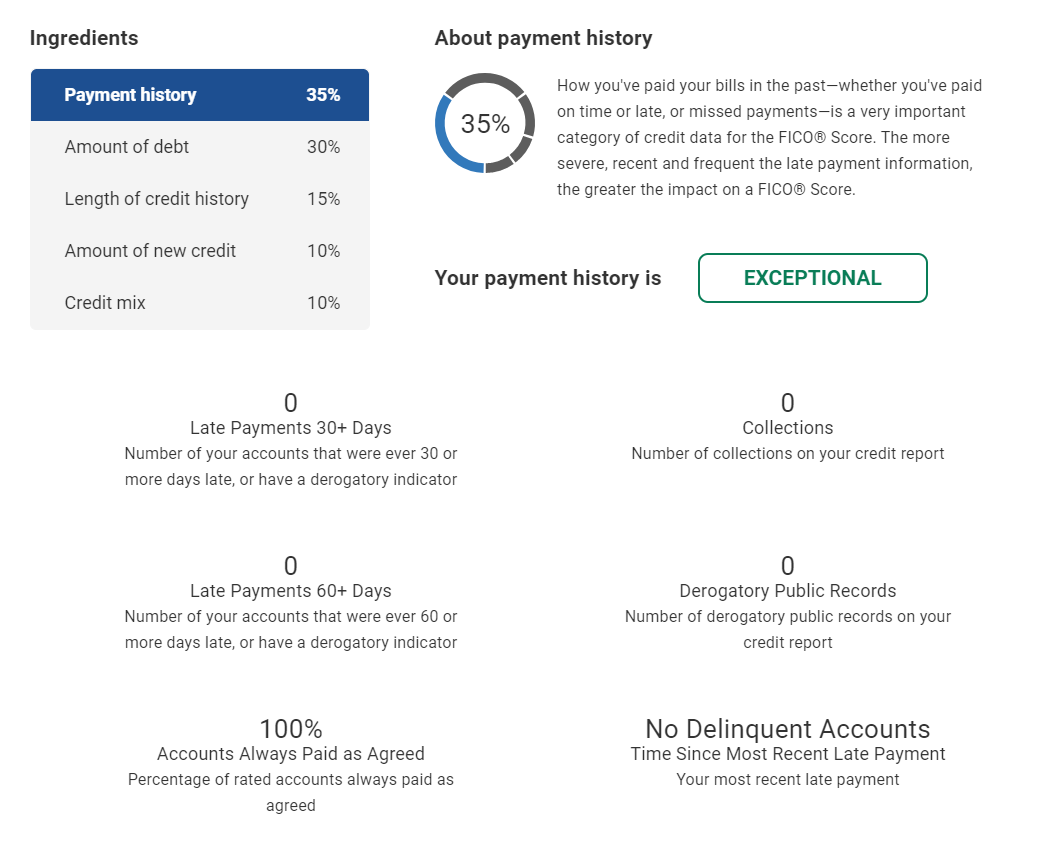

Credit mix accounts for 10%, with FICO rewarding borrowers who demonstrate that they can manage various types of debt, such as mortgages, auto loans, and revolving debt. New credit makes up the.

What Is A Good Credit Score?

A higher credit score means that you represent less risk to potential lenders. Around 17% of consumers have a fair FICO Score according to Experian data. Meanwhile, 13% of consumers have a fair.

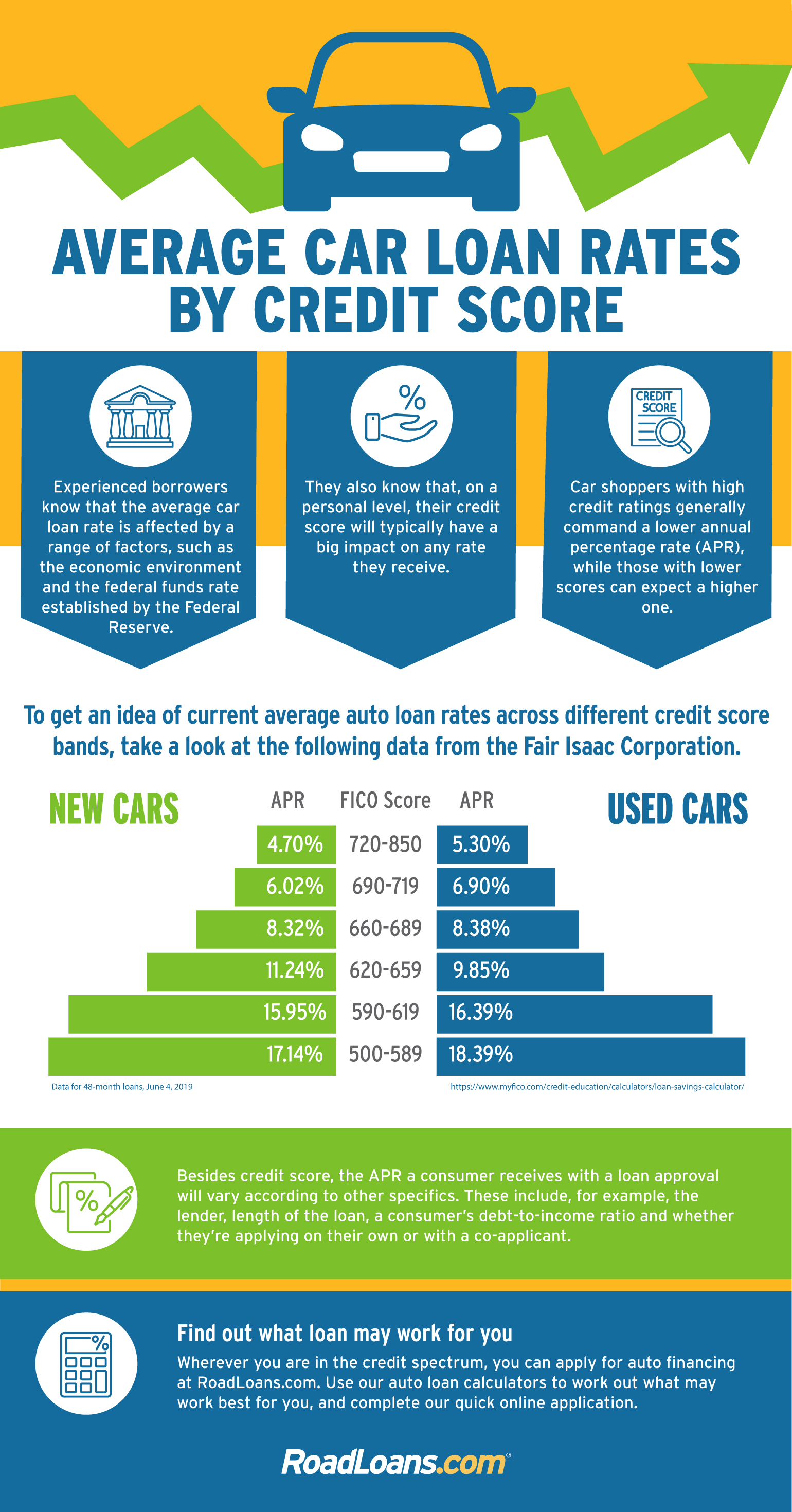

Check out average auto loan rates according to credit score RoadLoans

The FICO score is the brand of credit score used by most consumer lenders, so it's the one to pay the most attention to. FICO credit scores typically range from a low of 300 to a high of 850. (A.

581 Credit Score Car Loan

Good: 670-739. Fair: 580-669. Poor: 300-579. With good to exceptional credit, you have a good chance of getting approved by many auto lenders. If you have fair or poor credit, you may still be able to qualify for a loan, but lender options can be limited, and there may be other restrictions you have to deal with.

What Is a Credit Score?

Here are a few ways: Check your credit card, financial institution or loan statement. Many credit card companies, banks and loan companies have started providing credit scores for their customers. It may be on your statement, or you can access it online by logging into your account.

What is a Good Credit Score 2022 Credit Score Chart & Range

FICO Score. Payment history (35%): Whether you've paid past credit accounts on time. Amounts owed (30%): The total amount of credit and loans you're using compared to your total credit limit.

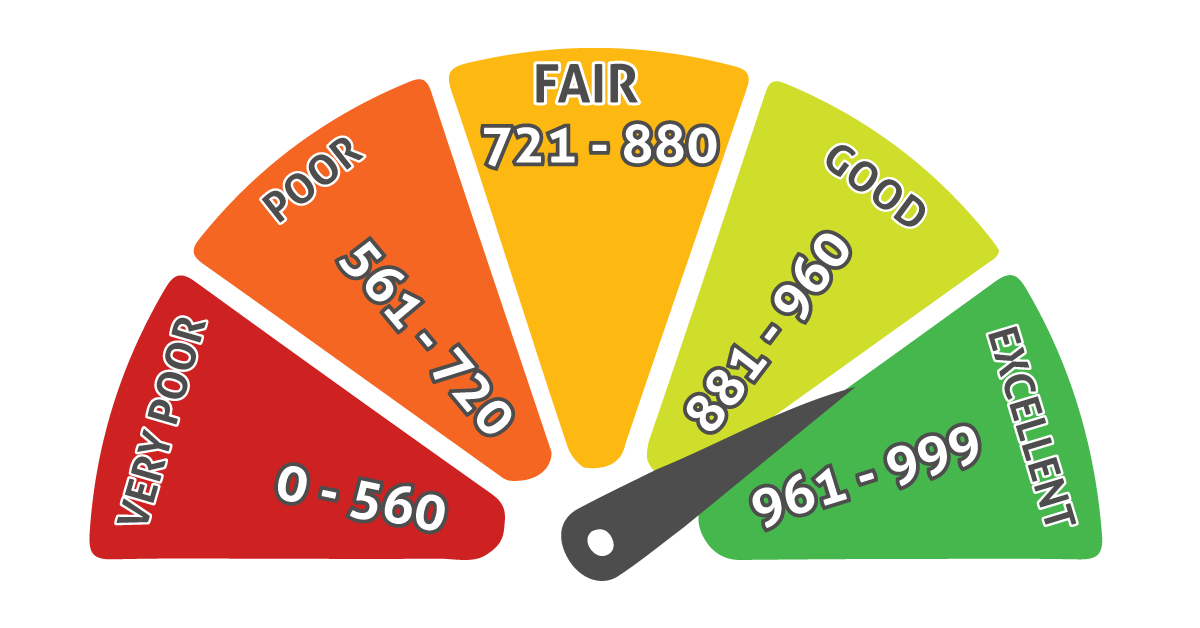

Experian credit score rating Scale

Yet FICO, the most widely known credit scoring model, shares some helpful information borrowers can use as a guide. The most common FICO scores feature a scale of 300 to 850. On that scale, a.

FICO Score vs Credit Score What’s the Difference? LendingTree

The average FICO credit score in the US is 717, according to the latest FICO data. The average VantageScore is 701 as of January 2024. Credit scores, which are like a grade for your borrowing.

Credit Score Ranges Explained Lexington Law

Usually, higher scores mean lower interest rates on loans. A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 7.01% or better, or a used.