The Truth About Car Payments & Auto Loans From ExCar Salesman Elder

The Truth About Cars is dedicated to providing candid, unbiased automobile reviews and the latest in auto industry news. Join Now; My History; Account Settings; Log out; News. Car Reviews.. Latest Car Reviews. Drive Notes: 2023 Ford F-150 Tremor. Drive Notes: 2024 Subaru Crosstrek Wilderness.

The Truth About Car Payments Car payment, Car insurance, Small luxury

But it's all coming together like a pileup on the expressway. On Tuesday, TransUnion reported that the percentage of American loans that are at least 60 days behind in their payments reached 1.65 percent in the third quarter of 2022. That's roughly 500,000 people who are delinquent and this is the highest rate witnessed in over a decade.

The Truth About Car Payments Murray Motive

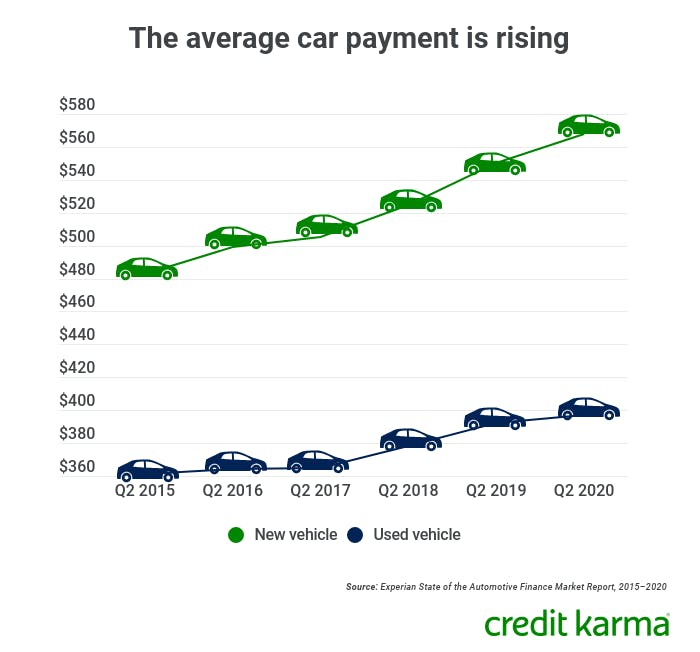

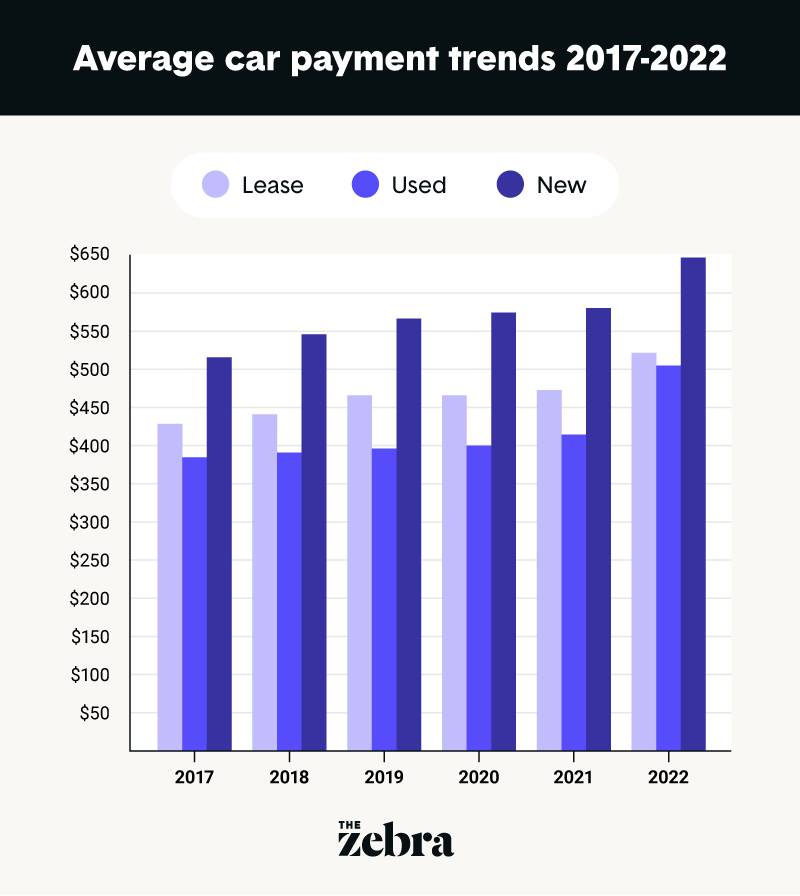

In the consumer arena, cars have become tightly sprung debt traps. The average monthly auto loan payment crossed $700 for the first time this year, which does not include insurance or maintenance.

How does your car payment compare? Wiser Wealth Management

Dealerships use 0% APR to move slow-selling cars and clear out inventory. You usually need a very high credit score to qualify for zero interest loans. Zero interest car loans usually come with a higher price tag, expensive extras and strict repayment terms. If you miss even one payment, you lose your 0% interest rate and get charged late fees.

Car Payments and Bankruptcy How It Can Help!

Step 1: Plug in your numbers. Some of the terms on the car payment calculator are simple. And some of them are as confusing as why you would need scissors to open a package of scissors. But don't worry—it's not just you. A lot of financial stuff can be confusing. And sometimes it feels like it's designed to be that way.

How Many Car Payments Can You Miss Before Repossession? Self. Credit

Frankly, that's a terrifying jump. And it's not just new cars. Edmunds estimates 5.4 percent of consumers who financed a used vehicle in the last quarter of 2022 committed to a $1,000+ monthly payment, also a record high, compared to 3.9 percent in Q4 2021 and 1.5 percent in Q4 2020. Paradoxically, consumers are apparently making bigger.

Car Financing 101 How to Pay for a Car Motor Era

The total cost of the car loan, insurance, fuel, and maintenance was $5,250 per year and $437.48 per month. Car payments are now the third-largest source of household debt in Canada, trailing only housing expenditures (32.5%) and food prices (18.82%). Car costs account for 15% of the average household budget, which is 7% higher than what.

Car Payment Guide Calculating What You Can Afford Autotrader

Key Takeaways. Financing a car is when you borrow money to purchase the car and agree to pay back the lender, plus interest, over a certain period of time. Types of financing include direct financing, indirect financing and leasing. Because you have to pay interest, financing a car always costs you more than buying a car with cash.

What Is the Average Car Payment? Credit Karma

A larger down payment will also help reduce the interest you will have to pay, said Macmillan. "Typically, it's recommended that you look for a down payment anywhere between 10 to 20 per cent.

Car payments explained EZ Tips Ep46 YouTube

10. If someone else drives your car, they cover any damage. Kicking us off at number 10 is the myth that insurance follows the driver, not the car. Wrong; it's the other way around. Car.

Automotive Payment Solutions Fast Lane to Car Maker Success

The Truth About Car Finance - Busting the Myths Unless you have applied for car finance before, it can be a confusing thing to tackle, especially when you are aware of the number of myths about car finance.You'll find a whole series of articles on car finance in our blog section, but to try and clear up some of the misconceptions more quickly, we've summarised the most common myths and whether.

Are Car Payments Bad? 5 Ways Your Car Payment is Keeping You Broke

58% of Americans are living paycheck to paycheck after the latest inflation spike. The average new car payment is now over $700 a month. The math ain't mathin'. The average American has some severe cash flow issues. A $700 car payment means that $700 can't be put toward savings, retirement, or paying down other debt.

The Truth About Car Payments Best marriage advice, Marriage advice

Each missed payment adds a late fee, and after 60 days, the lender reports a 60-day late notice to the credit bureaus, consequently impacting credit ratings and scores compared to a 30-day late notice. Furthermore, the second missed payment brings you closer to the risk of repossession and legal action. Therefore, the 60-day mark is crucial, as.

Car Payments First Source Team

The truth is, there's no one-size-fits-all answer. It depends on a variety of factors, including your lender, your state's laws, and the terms of your loan agreement. However, in general, if you're more than 30 days late on your car payment, you're at risk of repossession. Don't let a late car payment spiral out of control.

Average new car payment hits 648 How to calculate and lower monthly

01 - No Equity. The first biggest drawback of leasing a car is you aren't building any equity in the car when you are leasing. Yes, cars depreciate in value over time, unlike a home. A well-purchased home will appreciate in value over time. But pretty much all cars are worth less today than they did yesterday.

That’s Grand Record Numbers of Car Payments Exceed 1,000/mo The

Not that you couldn't have figured this one out all by yourself, but car loan delinquencies are reaching record levels once again. The culprits are the usual suspects. Wages have failed to keep pace with inflation for a couple of generations, current inflation rates are at record highs, and those loan-accommodation programs set up during the pandemic are all expiring now.