SmartAccess Prepaid Visa Debit Card review The Post New

Read reviews, compare customer ratings, see screenshots and learn more about PNC SmartAccess® Card. Download PNC SmartAccess® Card and enjoy it on your iPhone, iPad and iPod touch. **PLEASE NOTE, your card must be LOADED TO THE PNC SMARTACCESS® WEBSITE FIRST before you add it to this app. If you are installing the SmartAccess App for the.

Pnc Smart Access Card Review change comin

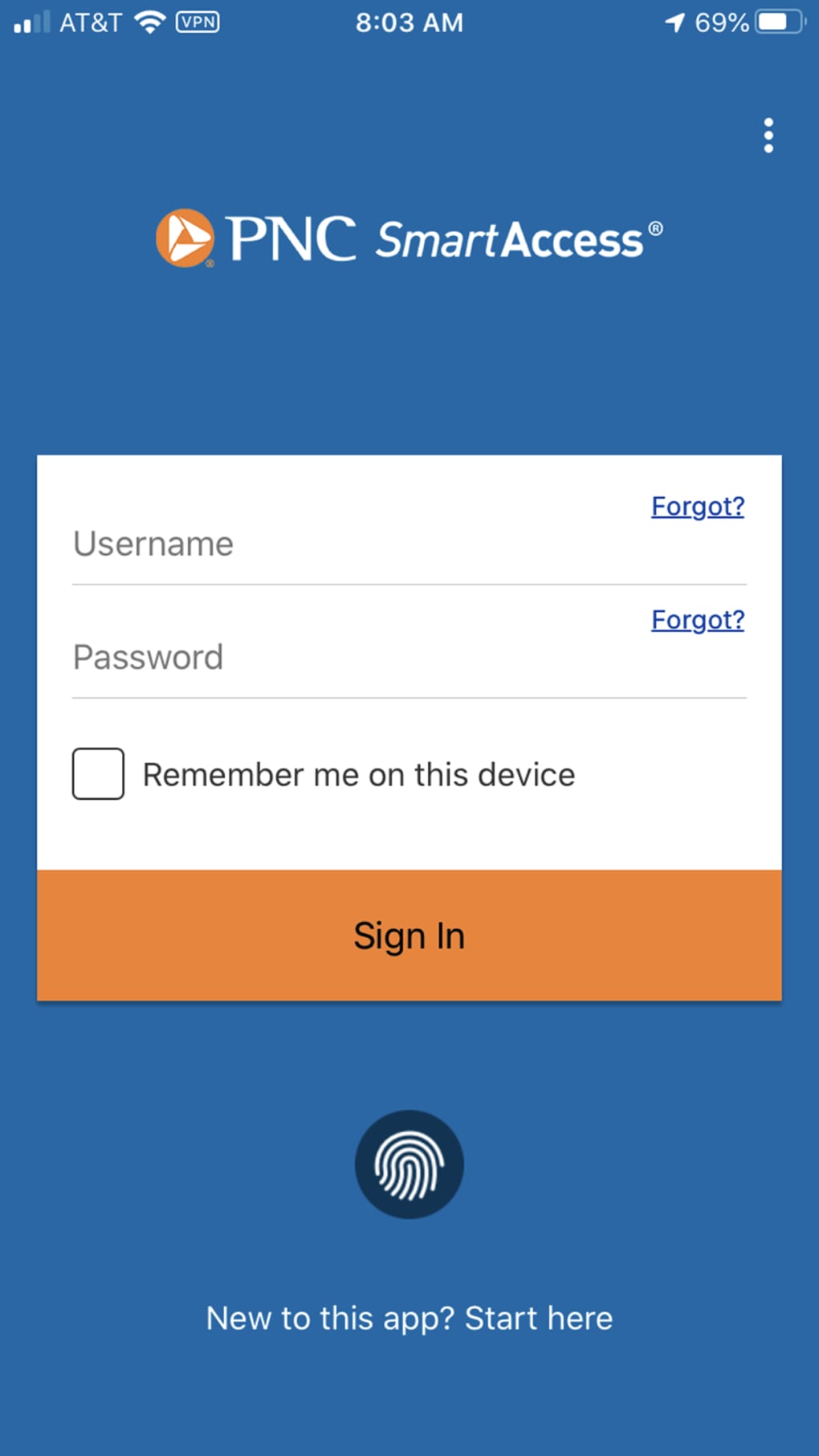

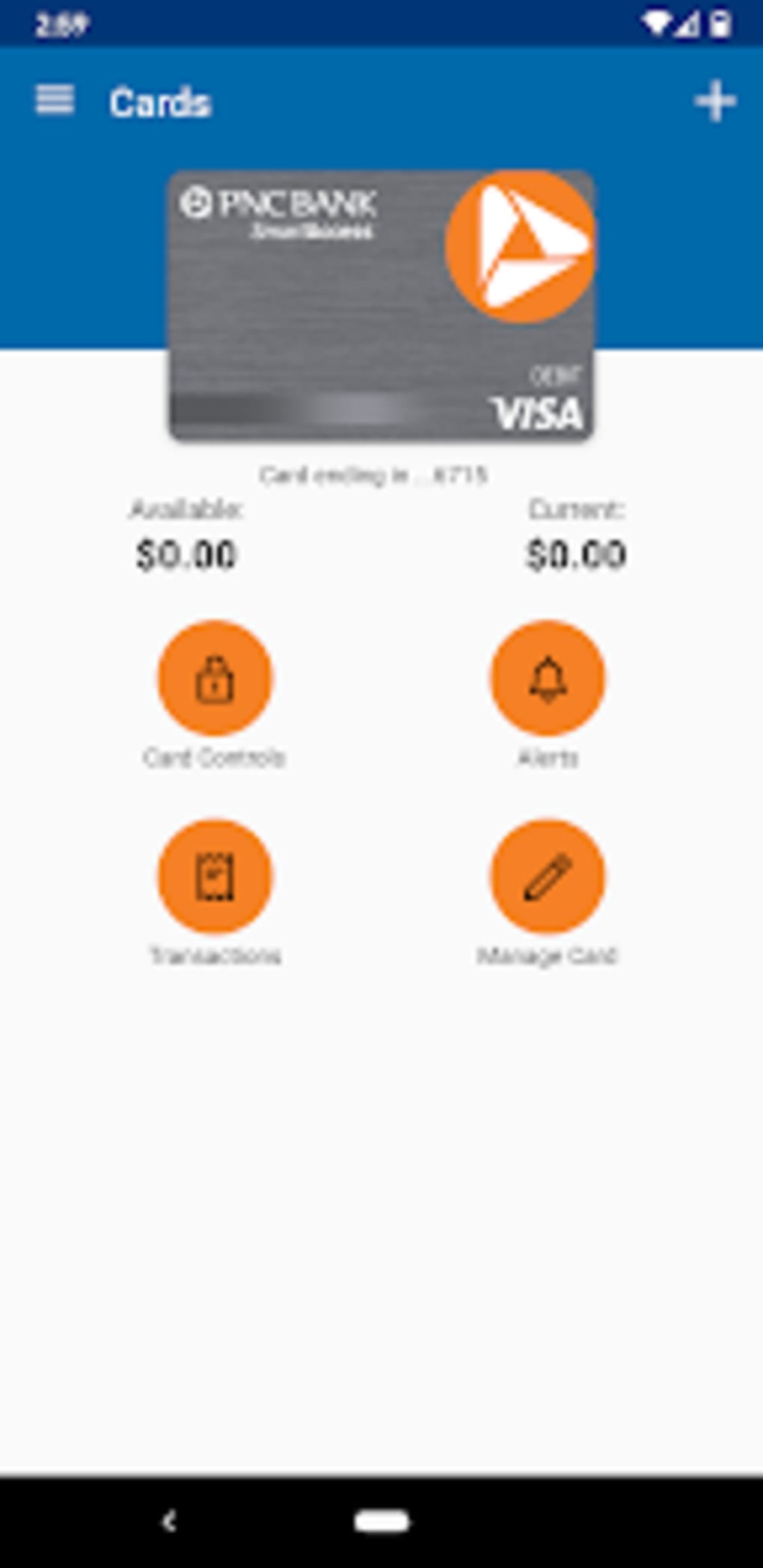

With the PNC SmartAccess® Prepaid Visa® Card mobile app from PNC Bank, you can now access your prepaid card information from your mobile device so you can bank on the go! Once you've created a new username and passcode for logging on, you'll have access to: * View balance * View transaction history * Suspend or reactivate cards * Manage.

:max_bytes(150000):strip_icc()/pnc_points_visa_credit_card_FINAL-1c09a80e82df4fe4816bed6bbf10c838.png)

PNC points Visa Credit Card Review

The limits are a bit lower than the average prepaid card. The maximum card balance for the PNC SmartAccess card is $10,000-somewhat lower than the average prepaid card. The daily spending limit is $2,500, also a little lower than average. The daily ATM cash limit is $500, also lower. However, the daily cash load limit of $5,000 is higher than.

PNC SmartAccess Card for iPhone 無料・ダウンロード

SmartAccess card will be declined and your card will be closed. You can continue to use your card until October 31. If your SmartAccess card is due to renew before October 31, 2023, PNC will send you a new card you can use until the closure date. Please deplete your funds prior to October 31. If funds remain as of October 31, PNC will send

PNC SmartAccess Card para Android Download

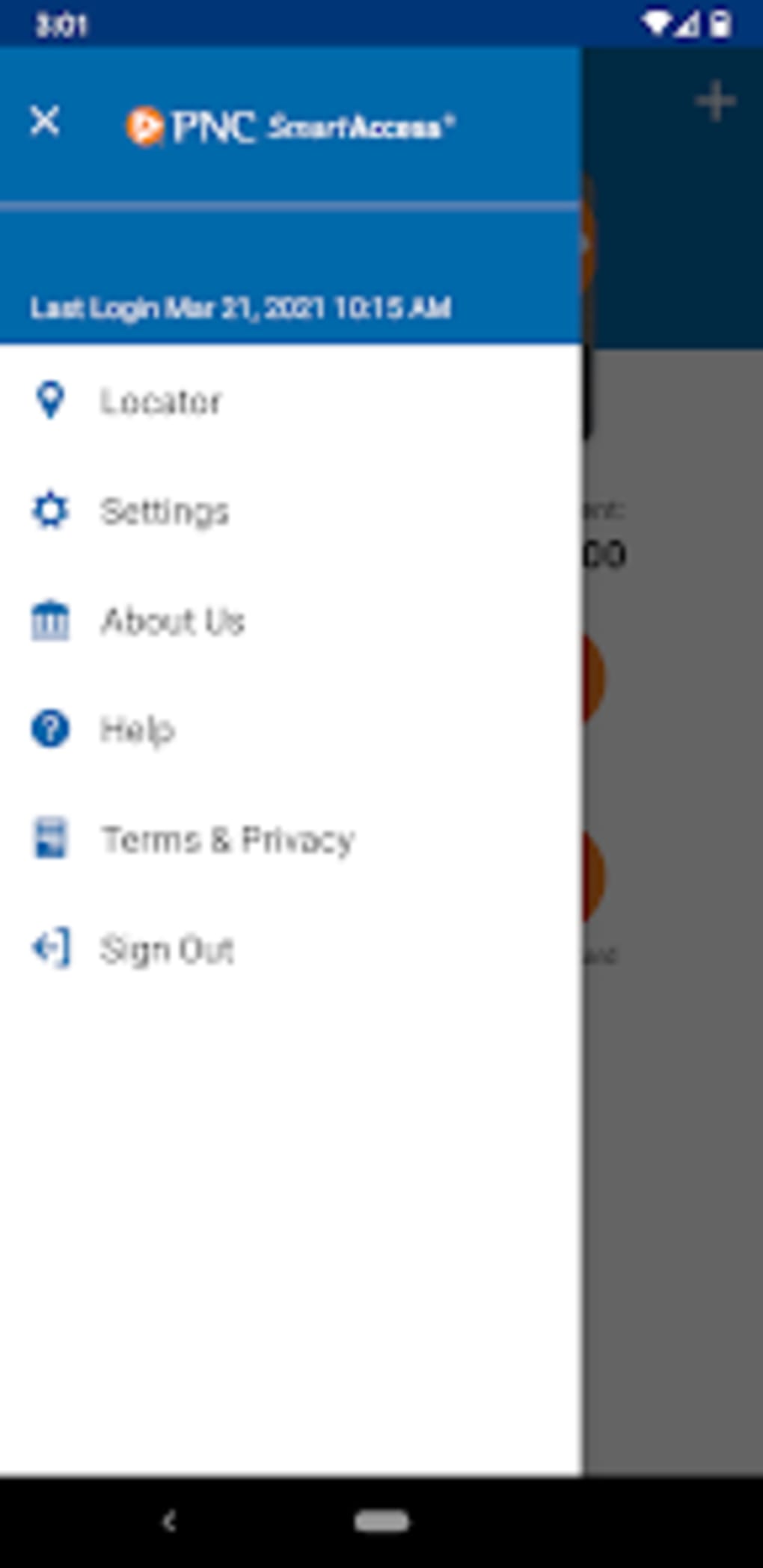

Generally, here are your options if you need your account deleted: Option 1: Reach out to PNC SmartAccess via Justuseapp. Get all Contact details →. Option 2: Visit the PNC SmartAccess website directly Here →. Option 3: Contact PNC SmartAccess Support/ Customer Service: 85.71% Contact Match. Developer: PNC Bank, N.A. E-Mail: mobil Click to.

PNC SmartAccess® Card by PNC Bank, N.A.

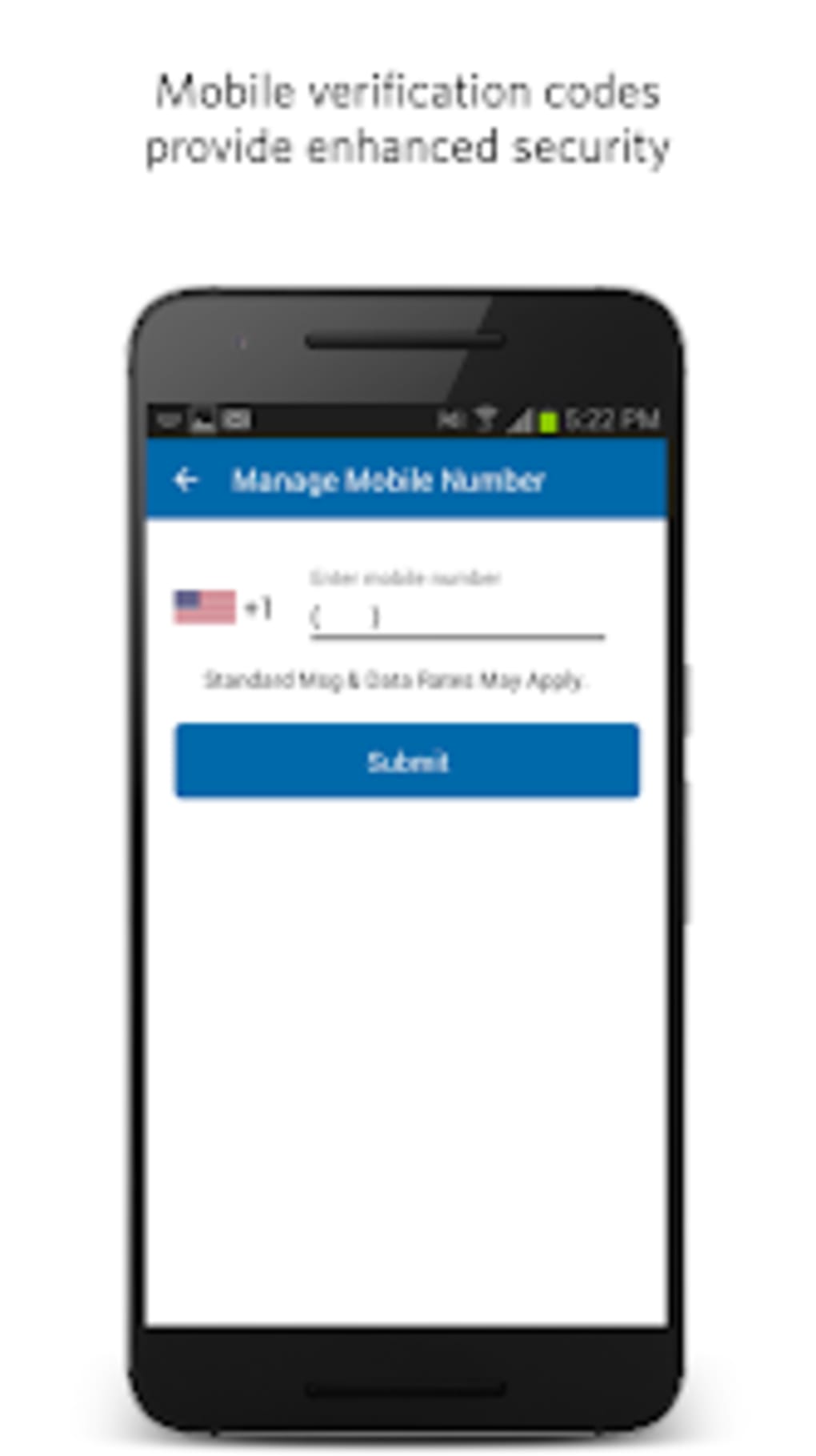

About this app. With the PNC SmartAccess® Prepaid Visa® Card mobile app from PNC Bank, you can now access your prepaid card information from your mobile device so you can bank on the go! Mobile data transmissions and card information are protected by 128-bit encryption, just like they are when you bank online.

PNC Smart Access Card Account Login Process

It's 50/50. Love my Card. Love being able to take out multiples of 1's. The app is terrible. I was using it and then one day it stopped logging back in. I used the same info because it's saved to my phone. Called SmartAccess and was told they would call me back once they figured out the problem. That was sometime last year and never heard.

SmartAccess Prepaid Visa Debit Card review The Post New

Existing SmartAccess Prepaid Visa accounts will be closed on October 31, 2023. Current cardholders were mailed a letter with additional information regarding account closure. Please visit the SmartAccess Customer Service section for more information or call (866) 304-2818 with questions. SmartAccess Summary of Fees, Schedule of Fees & Terms and.

PNC SmartAccess Card para Android Download

Yes. PNC SmartAccess® Card is quiet safe to use but use with caution. This is based on our NLP (Natural language processing) analysis of over 11,799 User Reviews sourced from the Appstore and the appstore cumulative rating of 4.7/5 . Justuseapp Safety Score for PNC SmartAccess Is 24.8/100.

PNC Cash Rewards® Visa® Credit Card Review Fortune

With the PNC SmartAccess® Prepaid Visa® Card mobile app from PNC Bank, you can now access your prepaid card information from your mobile device so you can bank on the go! Once you've created a new username and passcode for logging on, you'll have access to: * View balance. * View transaction history. * Suspend or reactivate cards.

PNC Bank Review 2023 Checking and Savings Accounts People's Investor

You can now access your prepaid card information from your mobile device!

PNC Debit Card

PNC Bank is an average credit card company overall, but it is good for no annual fees, 0% APR intro offers, and rewards, according to reviews. PNC Bank credit cards also have a solid user rating of 3.7/5 on WalletHub, based on more than 7,000 reviews. Reasons Why PNC Bank Is an Average Credit Card Company. 3.7/5 average user rating on WalletHub.

PNC SmartAccess® Card APK voor Android Download

To break it down further, PNC Cash Rewards® Visa® Credit Card earned a score of 3.8/5 for Fees, 3.4/5 for Rewards, 3.8/5 for Cost, and 3.7/5 for User Reviews. Info about the PNC Cash Rewards® Visa® Credit Card has been collected by WalletHub to help consumers better compare cards. The financial institution did not provide the details.

Login to your PNC

About the PNC Cash Rewards Visa Credit Card. The PNC Cash Rewards Visa Credit Card is a fine choice for those looking to earn competitive cash-back rates on gas and dining. Cardholders can earn 4%.

tarjeta inteligente pnc

This review focuses on PNC's personal banking services. Account details and annual percentage yields (APYs) are accurate as of Jan. 18, 2023.. a free debit card and access to PNC's fee-free.

PNC SmartAccess Card para Android Download

PNC Mobile Banking Reviews. Published by PNC Bank, N.A. on 2023-11-15. About: Check balances & recent transactions - See current account activity for your. checking, savings, credit card and loan accounts. Protect your accounts - Set. up Touch ID or Face ID to securely sign on to the app. Rating 4.8/5.