Dave Ramsey House He Paid Millions Cash for his Franklin TN Home

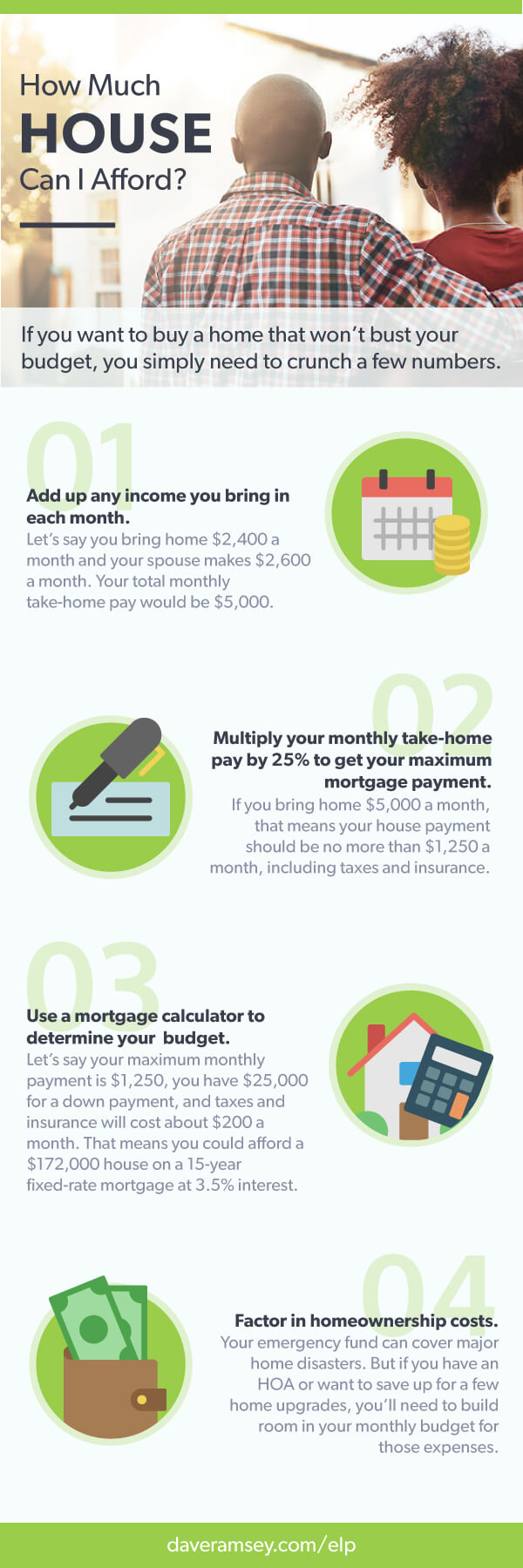

1. Figure out 25% of your take-home pay. To calculate how much house you can afford, use the 25% rule we talked about earlier: Never spend more than 25% of your monthly take-home pay (after tax) on monthly mortgage payments. That includes your mortgage principal, interest, property taxes, home insurance, PMI and HOA fees.

Buy Financial Guru Dave Ramsey's Tennessee House OutKick

Figuring out how much house you can afford. For starters, Ramsey says a mortgage payment should be no more than 25% of your take-home pay. "If your payment is more than that, you'll end up being.

Is Dave Ramsey Right About How Much House You Can Afford? Dave ramsey

1. Determine how much you can spend. According to the Ramsey Solutions blog, the first step you should take when determining how much house you can afford is to calculate 25% of your take-home pay.

Dave Ramsey Lists Nashville Home for 15.45 Million The Roys Report

Dave Ramsey has some advice on how much house you can afford. He recommends keeping housing costs to 25% of income or less. Check out our pick for the best cash back credit card of 2024

Discover how much house you can afford according to Dave Ramsey and see

One family member mentioned Ramsey's advice, which is to save longer and pay for a house in cash. We broke down the facts: At the beginning of 2021, when we were ready to buy, the average cost of.

How Much House Can I Afford Dave Ramsey All You Need Infos

According to Ramsey, your monthly housing expenses should never be higher than 25% of your monthly after-tax income. So, if you take home $5,000 a month after taxes, you can afford a $1,250 total monthly housing payment. Therefore, you hardly need to use the calculator to follow this rule. To find out your monthly maximum mortgage payment, just.

Is Dave Ramsey Right About How Much House You Can Afford? Finance

Big difference and it will greatly change your affordability calculations. At 25%, you can afford either $1850/mo or $2004/mo all in (principal, interest, taxes and insurance). Good point. It's $3700 biweekly. Monthly income really depends on the amount of pay periods in a month.

PHOTOS Dave Ramsey's 15.4 million Franklin home for sale WKRC

How To Know How Much House You Can AffordCalculate your monthly mortgage payment: https://bit.ly/3AVutFEVisit the Dave Ramsey store today for resources to he.

Dave Ramsey's Best Home Buying Tips Family Handyman

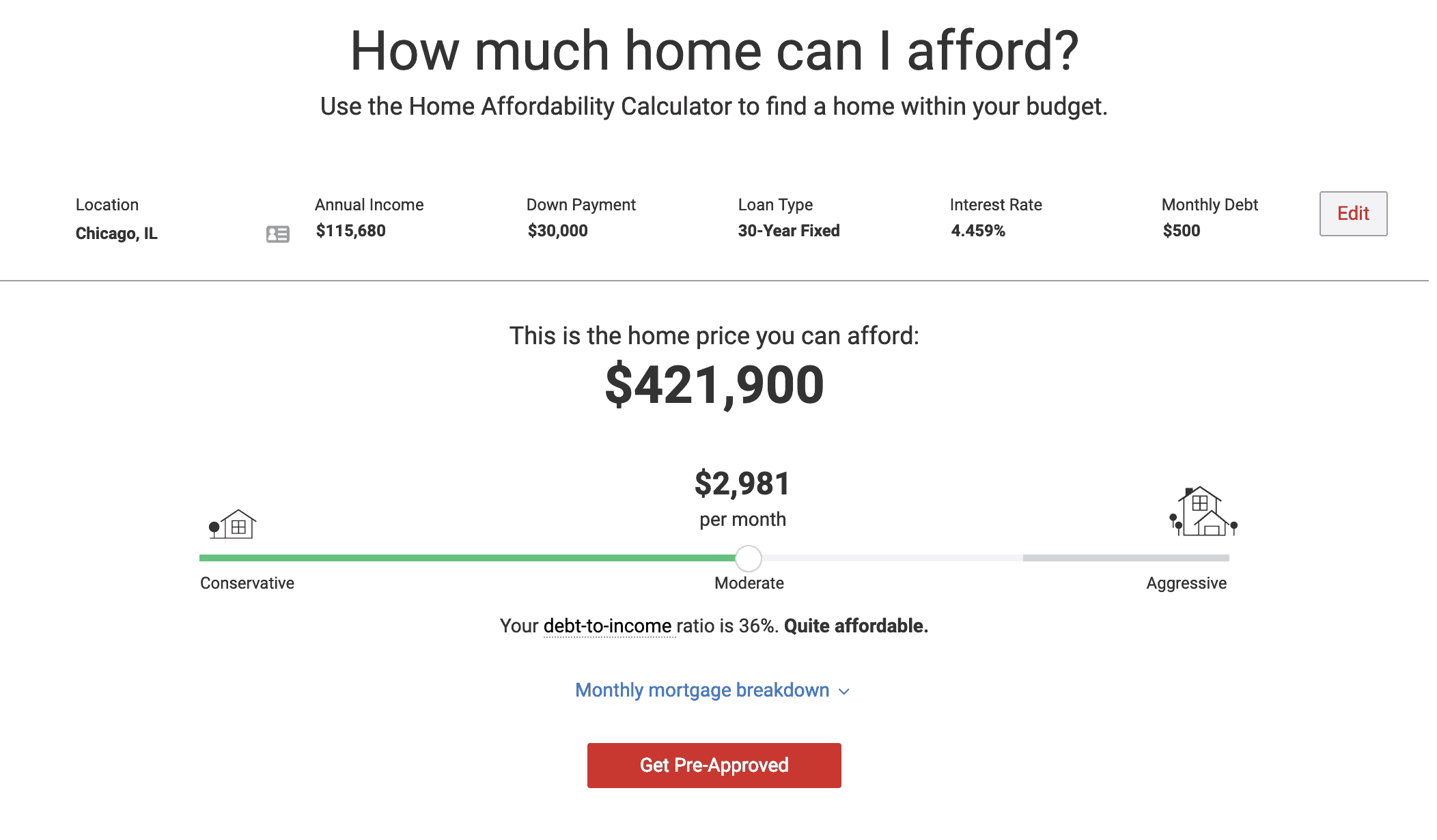

According to Zillow data, the median home value is $348,853, a 1.2% increase from last year. Not only that, but mortgage interest rates are still hovering around 7% on a 30-year fixed-rate mortgage loan. All of this combined with the rising cost of living can make it hard to find affordable real estate for you and your family.

How Much House Can I Afford?

Being able to afford a home in today's housing market can be a challenge. According to Zillow data, the median home value is $348,853, a 1.2% increase from last year. Not only that, but mortgage.

Is Dave Ramsey Right About How Much House You Can Afford? House down

Only Buy What You Can Afford. Ramsey recommends keeping monthly housing costs at 25% or less of monthly take-home pay. For example, if someone brings home $10,000 a month, the maximum house.

Is Dave Ramsey Right About How Much House You Can Afford? Dave ramsey

How Much House Can I Afford?Say goodbye to debt forever. Start Ramsey+ for free: https://bit.ly/35ufR1qVisit the Dave Ramsey store today for resources to hel.

Is Dave Ramsey Right About How Much House You Can Afford? Dave ramsey

Step 2: Figure out how much house you can afford. If you're ready to buy, your next step is figuring out your home-buying budget. You should only buy a house only when the monthly payment is no more than 25% of your monthly take-home pay. Anything more than that and you risk being house poor.

Discover how much house you can afford according to Dave Ramsey and see

Here's what Ramsey says you can pay for a house. Dave Ramsey has a simple answer to the question of how big your housing budget should be. "We recommend keeping your mortgage payment to 25% or.

Discover how much house you can afford according to Dave Ramsey and see

Dave Ramsey has one simple rule for calculating whereby much house you can buy, but should you follows his recommendation? Here's of background and context you need to know. Ramsey offers a simple framework for setting an house-hunting budget: your monthly payments should be no more than 25% of thine gain income.

How Much House Can I Afford Based On Dave Ramsey MUCHW

Money guru Dave Ramsey has much to say on what to do if you can't afford your housing market. Here's a look at some top tips, sourced from his blog, Ramsey Solutions. Sponsored: Protect Your.