How Much Money Do I Need To Buy A House Calculator Lindsay Fatinvand

Find Affordable Mortgage Options. Learn about the loan options that can make buying a home more affordable, including low down payment programs. Use the home affordability calculator to help you estimate how much home you can afford.

How Much Home Can I Afford? Home buying, Home buying tips, Home ownership

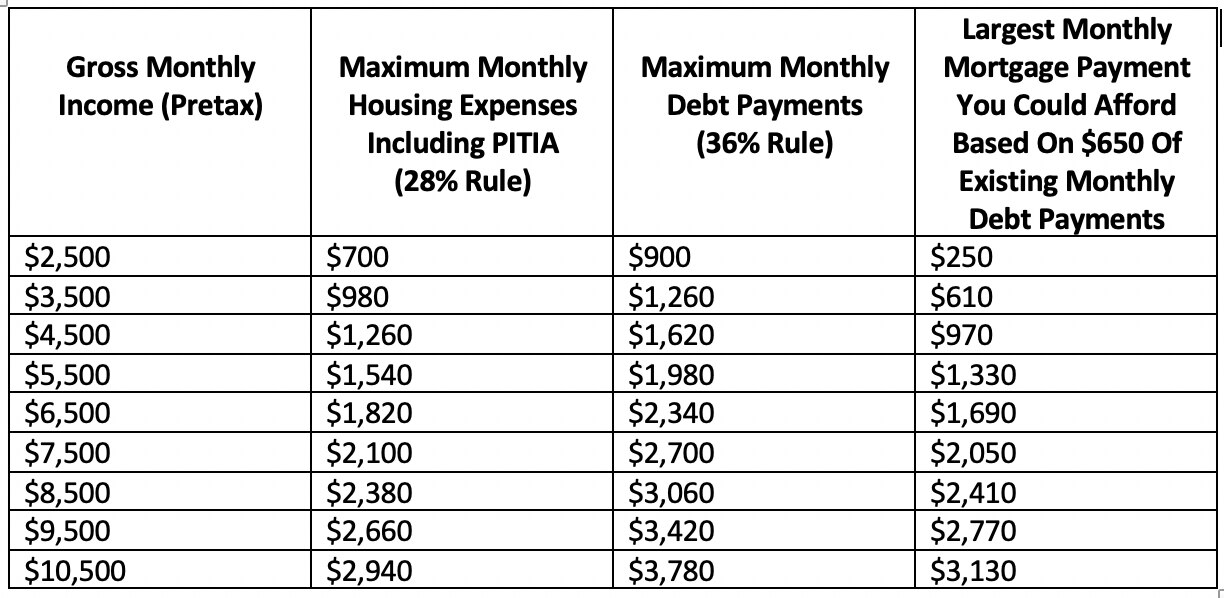

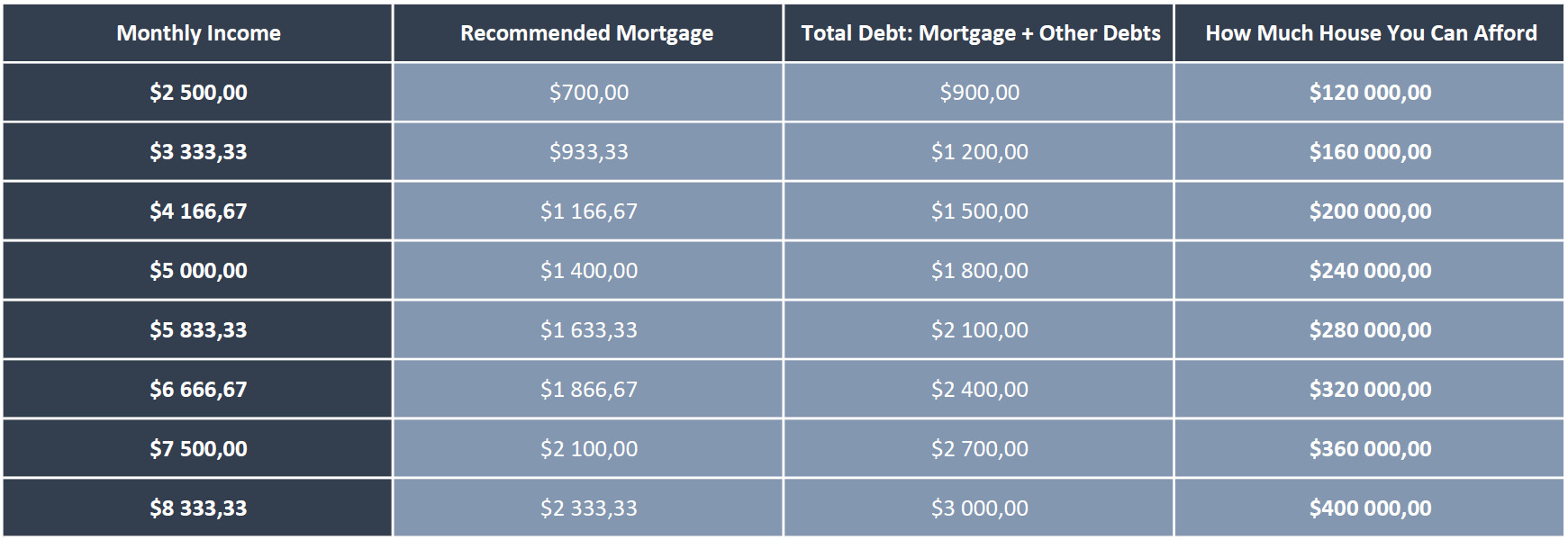

See how much house you can afford with our easy-to-use calculator. The debt-to-income ratio (DTI) is your minimum monthly debt divided by your gross monthly income. The lower your DTI, the more you can borrow and the more options you'll have. The above estimates do not include amounts for: (1) private mortgage insurance (PMI), which may be.

How Much House Can I Afford? Quick Guide To Home Affordability

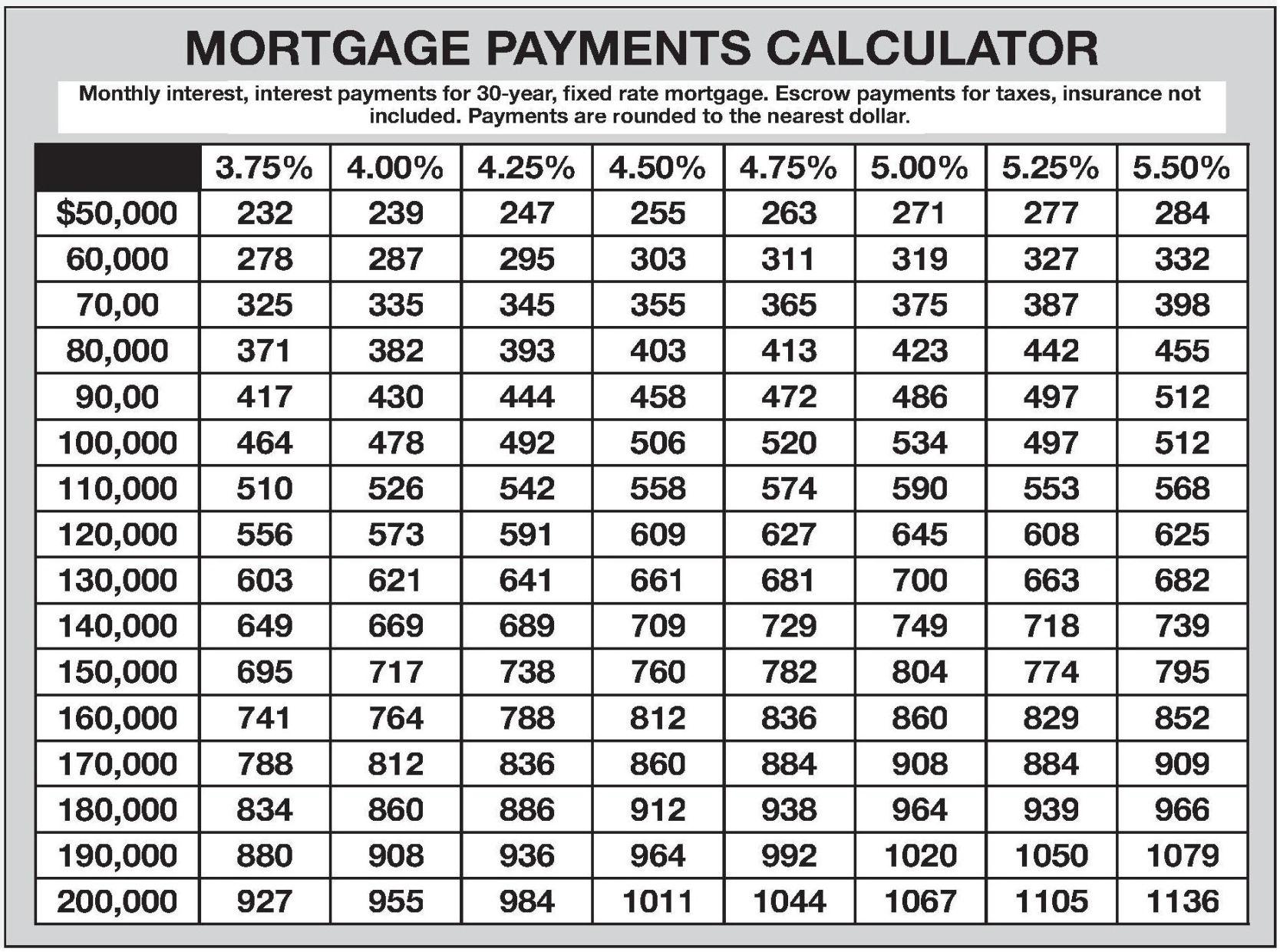

To figure out how much home you can afford with our calculator, enter your gross annual income and total monthly debts, choose a down payment amount and select a loan term. LendingTree's calculator defaults to a 30-year fixed-rate mortgage, but there's a 15-year fixed-rate term option if you want to save on interest charges and can afford a.

How Much House Can I Afford Base On My

For example, if you're thinking of a total monthly housing payment of $1,500 and your income before taxes and other deductions is $6,000, then $1,500 ÷ $6,000 = 0.25. We can convert that to a percentage: 0.25 x 100% = 25%. Since the result is less than 28%, the house in this example may be affordable. In addition to deciding how much of your.

HOW MUCH HOUSE CAN YOU AFFORD? Buying a home YouTube

The 28/36 Rule is a commonly accepted guideline used in the U.S. and Canada to determine each household's risk for conventional loans. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on the back-end debt.

How Much House Can I Afford 2021 Affordability Calculator

The question isn't how much you could borrow but how much you should borrow. These home affordability calculator results are based on your debt-to-income ratio (DTI). Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income. Learn more.

How much house can I afford How Do I Calculate How many houses I Can

See below for estimated DTI percentages and how they relate in terms of your budget (what you can afford in monthly payments based on the information you have provided). 20-27%. Quite affordable.

How Much House Can I Afford? Home Affordability Calculator

To get the best mortgage loan, know how much you can afford and shop like the bargain hunter you are. Read more Down Payment Assistance: How to Get Help Buying a House

How Much House Can I Afford? Mortgage, Affordable, Mortgage payment

Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage insurance premiums along with your.

Here's how to figure out how much home you can afford

The amount of money you spend upfront to purchase a home. Most home loans require a down payment of at least 3%. A 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase your affordability. For a $250,000 home, a down payment of 3% is $7,500 and a down payment of 20% is $50,000.

How Much House Can I Afford With Pmi MUCHW

How Much House Can I Afford? Home Buying - 11-minute read Wondering how much house you can afford? Learn more about how to figure out how much you can spend on a mortgage and use our home affordability calculator here. Rocket Sister Companies Buy a home, refinance or manage your mortgage online with America's largest mortgage lender¹.

HOW MUCH HOUSE CAN YOU AFFORD?

Combined with their debt payments, that adds up to $1,200 - or around 34% of their income. House #2 is a 2,100-square-foot home in San Jose, California. Built in 1941, it sits on a 10,000-square-foot lot, and has three bedrooms and two bathrooms. It's listed for $820,000, but could probably be bought for $815,000.

It's important to know how much home you can afford before you start

How we calculate how much house you can afford. Our home affordability calculator estimates how much home you can afford by considering where you live, what your annual income is, how much you have saved for a down payment, and what your monthly debts or spending looks like. This estimate will give you a brief overview of what you can afford.

Budgeting For Your New Home The First Step CotswoldHomes

For example, closing costs can be 2 - 5% of a home's price. Taxes and insurance also add to your mortgage payment. Understanding these numbers helps give you a more realistic idea of what's affordable.

How much house can I afford? Buying your first home, Shop house plans

n: Number of payments over the life of the loan. Multiple your loan term by 12 to determine the total number of payments. For example, a 30-year fixed-rate loan will have 360 monthly mortgage.

I make 70000 a year How much house can I afford Money Bliss

To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly income on home-related costs and 36% on.