FICO Score 8 and Why There Are Multiple Versions of FICO Scores myFICO

FICO 5. FICO 8. FICO 9. FICO 10 and 10T. FICO 8 remains the most widely used score, but several lenders have switched to FICO 9, which is more forgiving of unpaid medical bills. The FICO 10 Suite.

How FICO Score 9 Is Different From FICO Score 8 To Boost Credit Rating

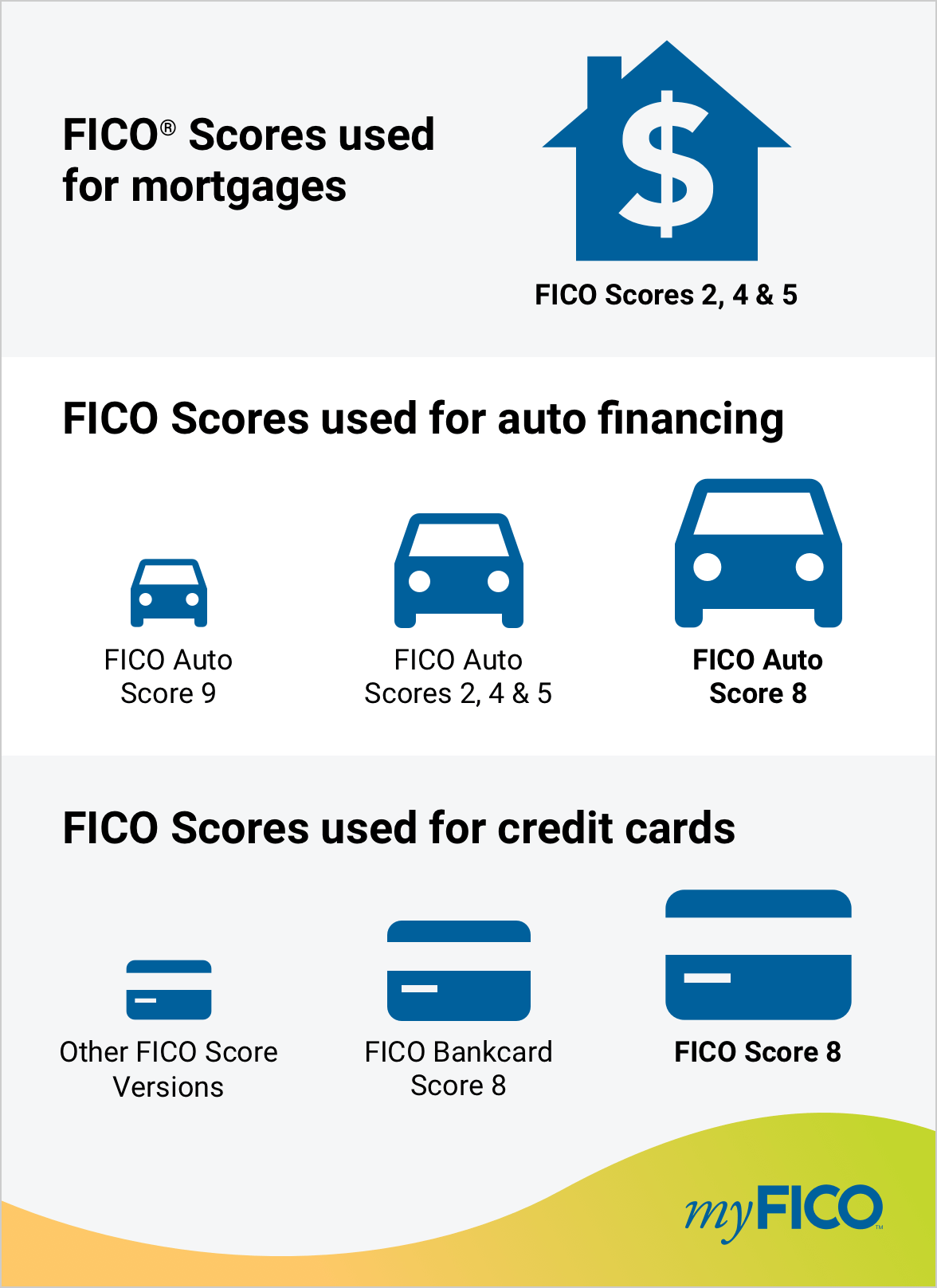

FICO 8 is a widely used credit scoring model that assesses credit risk on a scale from 300 to 850.. Earlier FICO Scores are also still in use. Mortgage lenders use FICO 2, FICO 4, or FICO 5, for example, depending on which credit bureau they approach for information. This is due to a Federal House Finance Agency (FHFA) mandate that these.

What Scores Do Mortgage Lenders Use and Why Should You Care? YouTube

FICO (NYSE:FICO), the leading provider of analytics and decision management technology, today announced that its latest credit scoring product, the FICO (R) 8 Mortgage Score, is now available from all three major U.S. credit reporting agencies. Mortgage lenders now have access to more precise risk assessment tailored for the real estate market.

How Mortgage Interest Works? AZexplained

Top Mortgage Lenders Scotsman Guide

As more lenders employ the FICO 8 credit-scoring system, borrowers should be aware of how this may affect them. you accept our . use of cookies. x Education Reference Dictionary Investing 101 The 4 Best S&P 500 Index Funds World's Top 20 Economies Stock Basics Tutorial Options Basics Tutorial. Mortgage Insurance Small Business Wealth.

Which FICO Scores Do Mortgage Lenders Use?… (With images) Mortgage

The commonly used FICO ® Scores for mortgage lending are: FICO® Score 2, or Experian/Fair Isaac Risk Model v2. FICO® Score 5, or Equifax Beacon 5. FICO® Score 4, or TransUnion FICO ® Risk Score 04. Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO.

What FICO score is used to buy a house? Leia aqui Which FICO score do

The credit score used in mortgage applications. While the FICO ® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply.

AEFCU How lenders use FICO® Scores YouTube

Not sure where you are located. However my Leander McLean Mortgage uses FICO 8 in Virignia. I'm closing Monday and all they used was my FICO 8. My FICO 8 mid score is 624, but my FICO 4,5,2 mid score is only 603. So, I'm thinking I would benefit more from a lender that uses FICO 8. - 5215980.

What FICO score do lenders use for mortgage? Leia aqui What is the

FICO 8 may be used for different types of credit, including auto loans and bank card loans. While it's sometimes used in the mortgage industry, mortgage lenders most often use FICO 2, 4, and 5 to help determine creditworthiness. Each of these is built on data from one of the credit bureaus. FICO 5 is built on data from Equifax, while FICO 4.

Do mortgage lenders use the lowest FICO score? YouTube

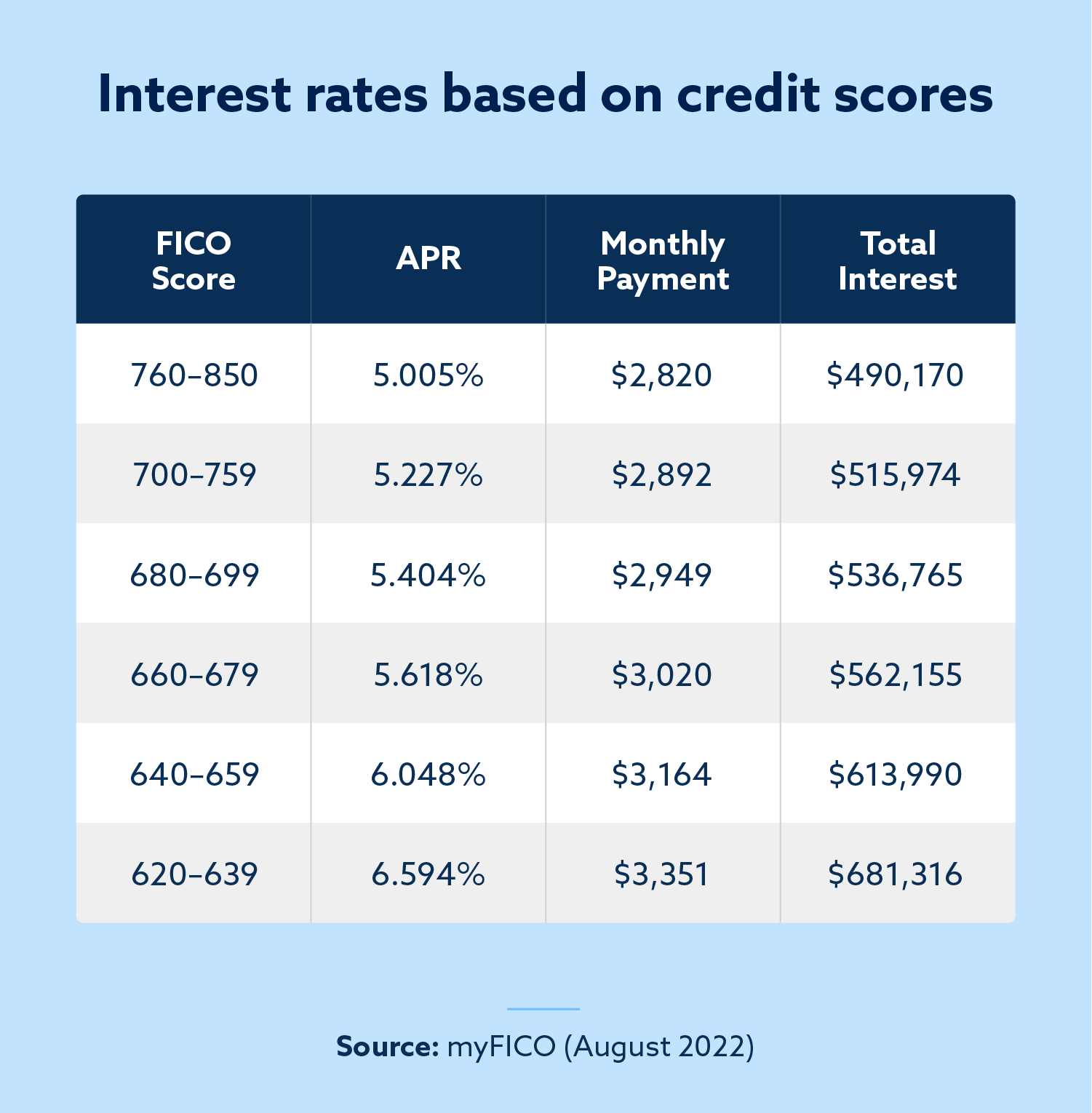

For instance, mortgage lenders tend to use different scoring models than those used for general lending decisions, such as credit cards. While most lenders use the FICO Score 8, mortgage lenders.

How Do You Comparing Mortgage Lenders? Mort Jakartastudio

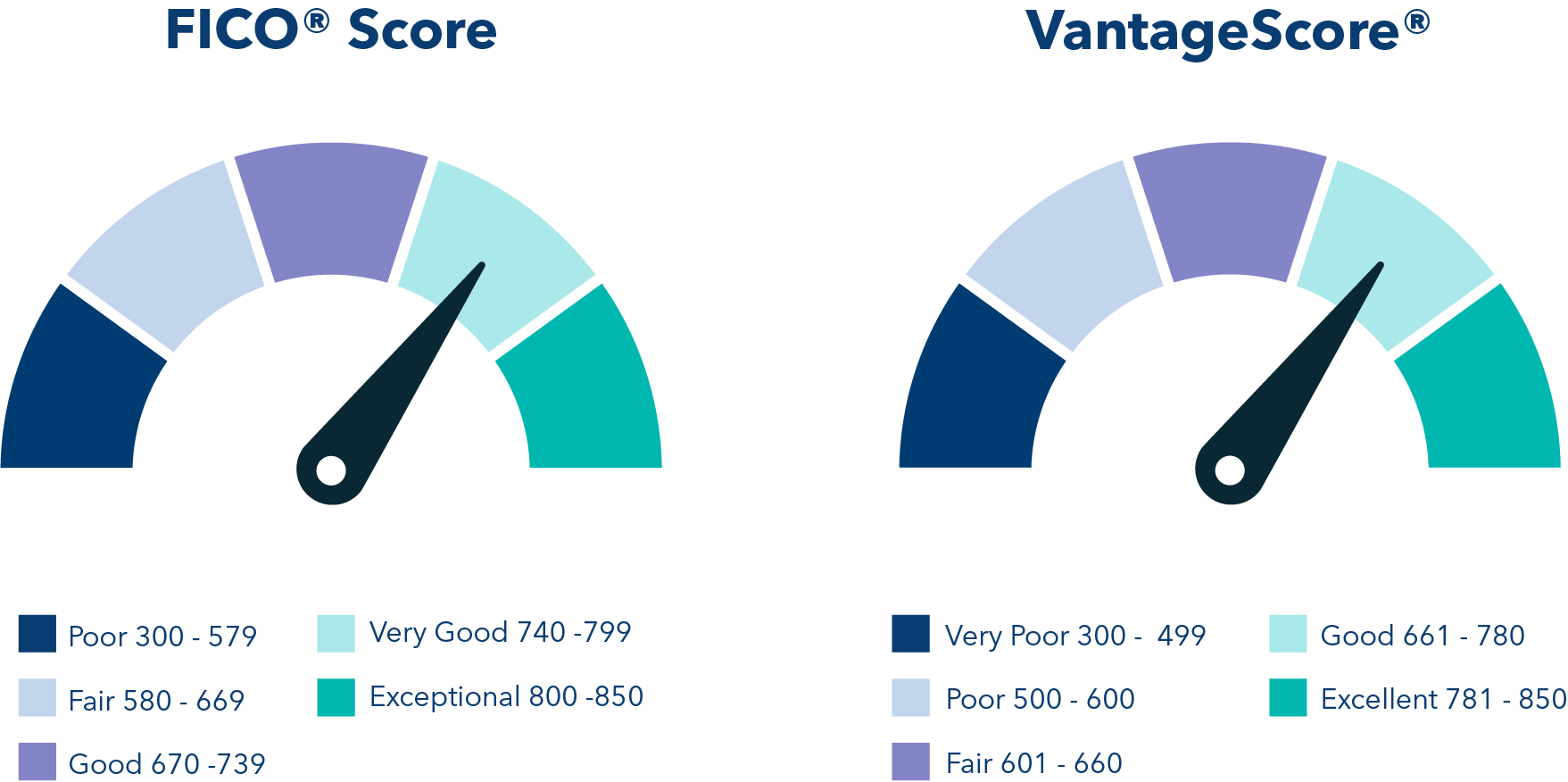

Do mortgage lenders use your FICO credit score? The most common credit score used in general lending decisions is the FICO 8. This score ranges from 300 to 850, where 300 is the worst score, and 850 is the best. This number is based on several factors, including the amount of available credit available to the candidate and their bill-paying.

Which Fico score do mortgage lenders use in 2022 YouTube

Base FICO® Scores, such as FICO® Score 8, are designed to predict the likelihood of not paying as agreed in the future on any credit obligation, whether its a mortgage, credit card, student loan or other credit product. Industry-specific FICO® Scores are designed to assess the likelihood of not paying as agreed on a specific type of credit.

What Factors do Mortgage Lenders Use During the Loan Process? Loanry

Do banks use FICO Score 8? Alright, here's the skinny: while banks love the FICO Bankcard Score 8 for credit cards and such, when it comes to home loans, they switch gears. They usually go for more specialized scores like FICO 2, 4, or 5—that's the stuff mortgage lenders are peeking at. So, FICO 8? Not the go-to for the home loan hustle.

Why Do Different Lenders Offer Different Mortgage Rates? Mort

How It's Calculated. Your FICO Score 8 is made up of these five components: Payment history (35%). The biggest single thing you can do to help your credit score is to make all of your payments.

The Best Mortgage Lenders for FirstTime Buyers of 2024 Picks by Bob Vila

If a lender has already requested a copy of your tri-merge credit report and mid-FICO score, for example, you can simply share this information to get a quote from any mortgage broker or lender. For an informal rate quote or analysis, they most definitely do not require a credit report, but only when they are prepared to formally secure pre.

What Credit Score Do Mortgage Lenders Use? Lexington Law

FICO 5 is more likely to be used by mortgage lenders (and, in some cases, financial institutions that issue auto loans) because a lot of money is at stake. It is less forgiving of unpaid.