30 Federal Solar Investment Tax Credit Sol Luna Solar

With the passage of the Inflation Reduction Act, batteries paired with solar panels in 2022 can receive the full 30 percent tax credit. Residential batteries typically cost between $12,000 and $16,000, so you can anticipate receiving a tax credit between $3600 and $4800 for installing them.

Texas Solar Incentives (Tax Credits, Rebates & More in 2023)

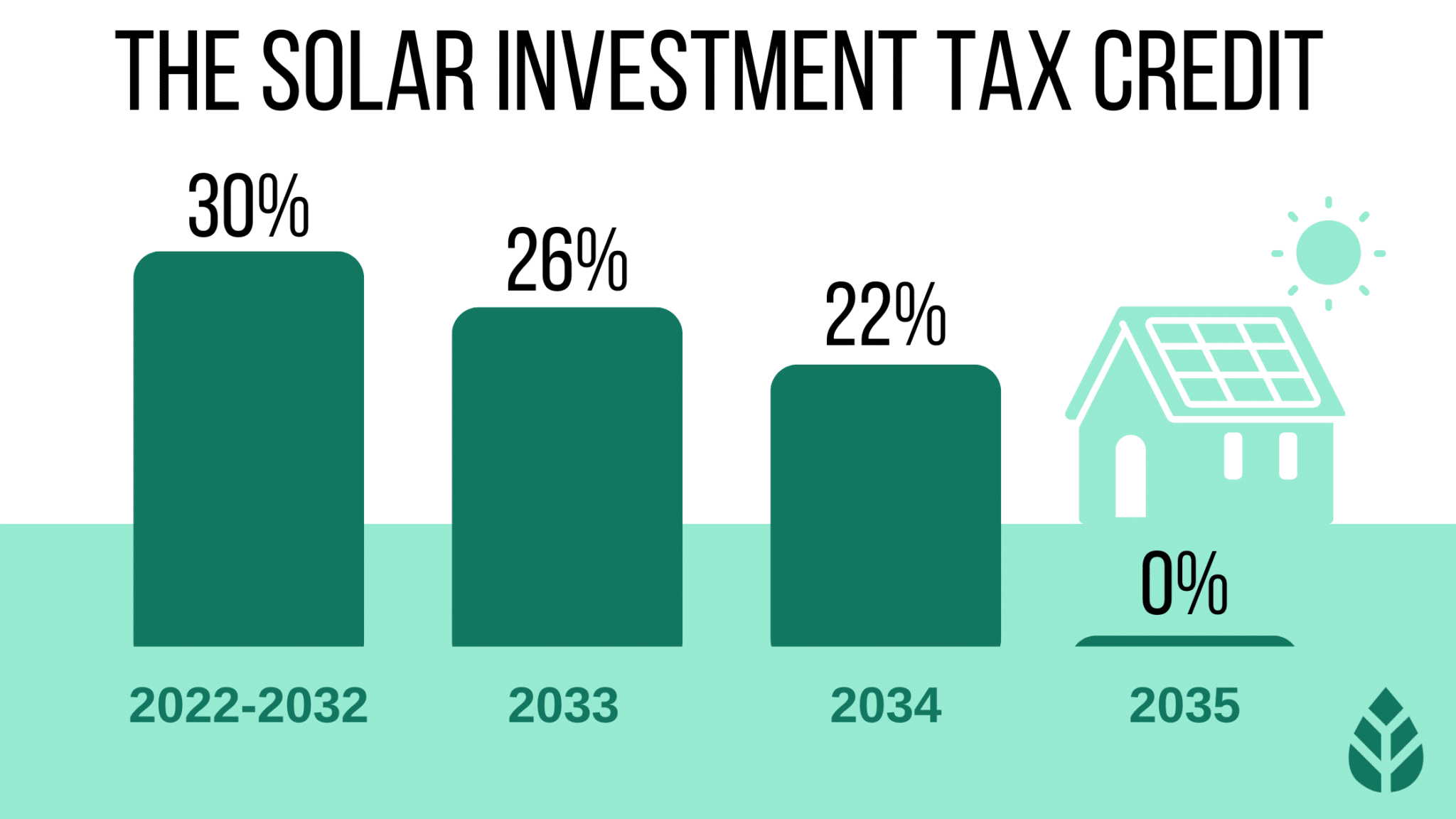

The Residential Clean Energy Credit equals 30% of the costs of new, qualified clean energy property for your home installed anytime from 2022 through 2032. The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034. You may be able to take the credit if you.

Solar Tax Credit What You Need To Know NRG Clean Power

Cost of a Solar System. Solar Tax Credit. Cost After Tax Credit. Solar Tax Savings. $31,558. 30%. $22,090. $9,467. Given that Congress has guaranteed the credit at 30% through 2034, you have plenty of time to consider your solar panel options and take advantage of the big savings the credit can bring you.

A Complete Guide To The Federal Solar Tax Credit

According to our 2023 survey of homeowners with solar, respondents paid an average of $15,000 to $20,000 for their solar panel systems. When you factor in the 30% federal solar tax credit, the.

Federal Solar Incentives Renewed Through 2023

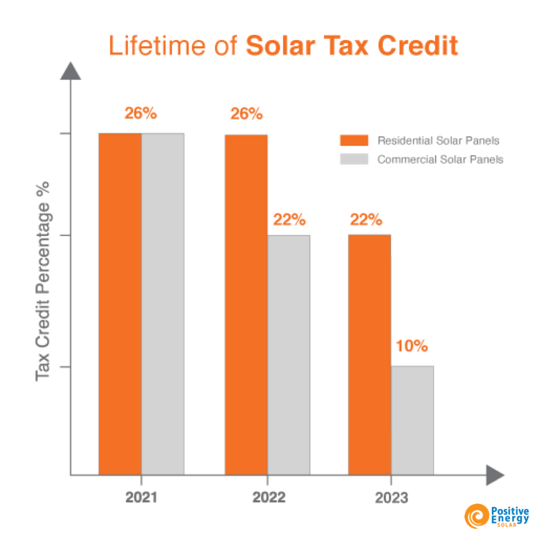

On the federal level, a 26% tax credit was offered in 2021 for solar systems installed between 2020 and 2022. For systems implemented in the tax years 2022 through 2032, the ITC now offers 30%. Therefore, consider a 26% to 30% saving while determining whether to install solar panels.

How to Claim Solar Tax Credit 2023? Internal Revenue Code Simplified

At 30%, the tax credit is worth $7,500 for a $25,000 solar system — effectively knocking the price down to $17,500. The credit was previously at 26% for systems installed in 2022 and scheduled to step down to 22% in 2023 before going away entirely in 2024. Better yet, Americans that installed solar in 2022 expecting a 26% credit will now be.

2023 Residential Clean Energy Credit Guide ReVision Energy

The Homeowner's Guide to Solar Tax Credits and Incentives. March 19, 2024; Financing and Billing, Solar Education,. you may know the federal solar tax credit as the investment tax credit (ITC), which was created by the Energy Policy Act of 2005 and enacted the following year.. Originally set at 30%, this residential incentive dropped to.

How to File the Federal Solar Tax Credit A Step by Step Guide

What is the History of the Solar Tax Credit? The Solar Tax Credit was established in 2005 as part of the Energy Policy Act. It offered an investment tax credit of 30% of solar expenditures. It was initially set to run from Jan 1, 2006, to Dec. 31, 2007, and expire at the end of the year, but legislation extended it by an additional year.

Save Big Federal Solar Tax Credit Guide for Homeowners 2023

For example, if your solar PV system was installed before December 31, 2022, installation costs totaled $18,000, and your state government gave you a one-time rebate of $1,000 for installing the system, your federal tax credit would be calculated as follows: 0.26 * $18,000 = $4,680. State Tax Credit.

How Does the Solar Tax Credit Work? ADT Solar YouTube

Total Impact on Tax Liability Assuming the business has a federal corporate tax rate of 21%, the net impact of depreciation deductions is calculated as: 0.21 * ($340,000 + $102,000) = $92,820. Therefore, the total reduced tax liability for 2025 from depreciation deductions and the ITC is: $300,000 + $92,820 = $392,820.

How the Solar Tax Credit Works 2022 Federal Solar Tax Credit

The federal solar tax credit can cover up to 30% of the cost of a system in 2024. The amount you can claim directly reduces the amount of tax you owe.. Personal loans guide; FAFSA and federal.

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

If purchasing and installing solar panels results in eligible costs of $30,000, for example, the tax credit can help you save $9,000 in taxes. If your eligible costs only total $15,000, on the other hand, the credit drops to $4,500. The Department of Energy estimates the average homeowner installing rooftop solar panels will enjoy tax savings.

Federal Solar Tax Credit Guide 2021 Thru 2023 Investment Tax Credit

Step 2: Rollover any remaining credit from last year's taxes. Line 12 - If you filed for a solar tax credit last year and have a remainder you can roll over, enter it here. If this is your first year applying for the ITC, skip to line 13. Line 13 - Add up lines 6b, 11 and 12. Example: 7,500 + 0 + 0 = 7,500.

Federal Solar Tax Credits for Businesses Department of Energy

a percentage of the cost of a solar PV system paid for by the taxpayer.2 (Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance.) • Solar PV systems installed in 2020 and 2021 are eligible for a 26% tax credit. In August 2022, Congress passed an extension of the ITC, raising it to 30%.

.png)

Federal Solar Tax Credit Extended Through 2022

The federal solar tax credit, commonly referred to as the investment tax credit or ITC, allows you to claim 30% of the cost of your solar energy system as a credit to your federal tax bill.If it costs $10,000 to install your solar panel system, you'll receive a $3,000 credit, which directly reduces your tax bill. On average, a typical EnergySage Marketplace shopper saves an extra $6,150 on.

Commercial Solar Tax Credit Guide 2023

The value of the federal solar tax credit in 2024 is 30% of the total cost of your solar installation. Considering that the average cost of solar installation is about $20,000, the usual value of the tax credit is around $6,000. However, the specific value of your solar tax credit will be determined by the specific cost of your solar installation.