How do I settle my original creditor collection lawsuit on my own?

Debt can indeed legally be sold or assigned, and a creditor's doing so does not relieve the debtor of obligation to pay — otherwise, the debt purchasing industry would not exist. Typically, a.

Myths 9 You Can Bypass the Debt Collector and Pay the Original Creditor

Sometimes instead of dealing with a collection agency, you can still strike a deal with the original creditor. A debt collector's only interest is squeezing money out of you while the creditor.

Can I pay original creditor instead of collection agency? Leia aqui

Let's say you have a credit line account with a department store. You owe a balance on the credit card and it was sent to collections.. If your desire is to pay the debt, then you could still call the owner of the debt and see it they wish to work with you to get the debt paid.. but the collection agency wants the original debt amount. 1.

Should I Pay The Collection Agency Or Original Creditor? YouTube

If you're being contacted by a debt collector, that means your original creditor probably already sold your debt to them. If you decide to pay your original creditor directly, the collection agency may not know about it and may continue to pursue you for payment. Instead, pay your debt to the debt collector rather than the creditor.

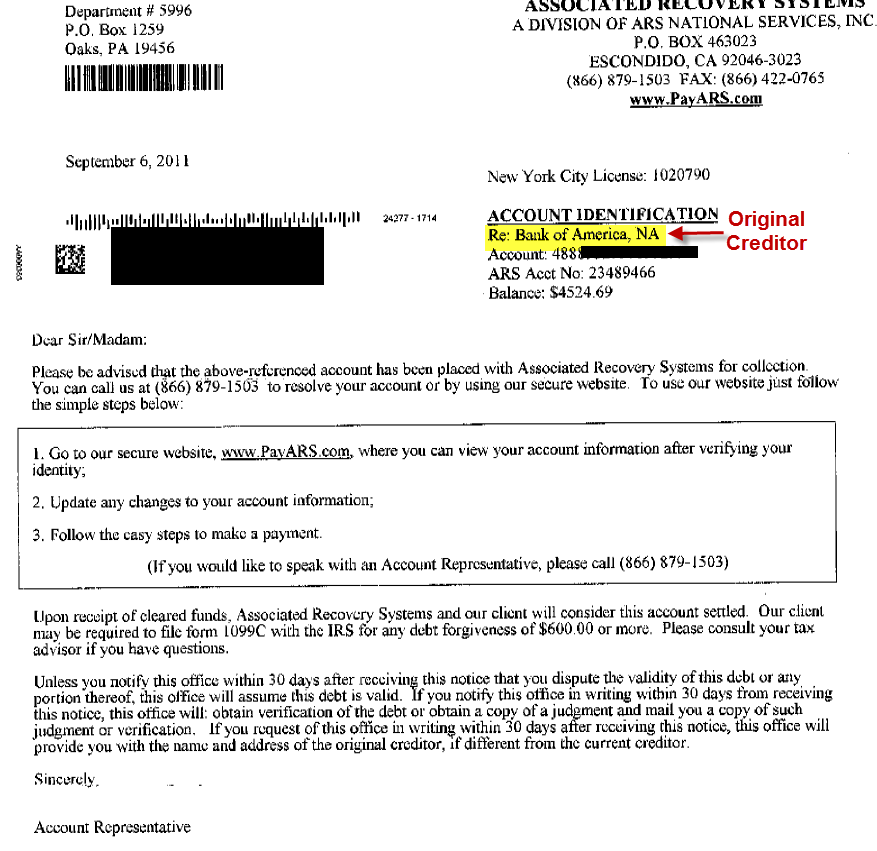

How do I find the Original Creditor on a Collection Letter? UGotiate

Selling or transferring debt from one creditor or collector to another can happen without your permission. However, it typically doesn't happen without your knowledge. By law, a consumer must receive written notice (known as a debt validation letter) within five days of the collector's initial attempt to contact you.

Original Creditor and Collection Agency on Credit Report

The name of the collection agency ; The original creditor ; The date that the debt was transferred to the collection agency; The amount you owe; Step 4: Repay The Debt You Still Owe. Once you've been provided with all the required information about your debt, you'll need to find a way to pay it back.

Should I Pay A Collection Agency or The Original Creditor? YouTube

Paid off a 3 year debt through the original creditor instead of the collection agency - any chance I can still have it removed from my credit report? I was surprised by a collections account showing on my credit report, and without knowing better, immediately went and paid it through the original creditor (a regional utility company) instead of through the collections agency.

HOW TO TELL IF ATTORNEY PURCHASED MY DEBT OR STILL WITH ORIGINAL

To pay your original creditor and negotiate directly with that creditor rather than a debt collection agency, ask the collection agency for the phone number of the original creditor's collections department. Then, call the creditor and ask if you can pay the debt with the creditor. Ideally, the creditor will immediately agree to accept payment.

How to Pay Off a Debt in Collections Financial Rescue, LLC

In some cases, you may still be able to negotiate repayment directly with your lender. Working with your original creditor instead of a debt collector can be beneficial. However, this approach won't work for everyone. Find out when you may qualify to bypass debt collectors and work directly with your original creditor to repay what you owe.

Creditor and Collection Agency Dispute screen(2023) YouTube

If you pay the hospital $1,000 for the debt, you will still have a legal obligation to pay the collection agency. If you're lucky, the hospital will send your payment to the collection agency. You should not bet on that happening. The original creditor could keep the money you owe and not inform the collection agency of anything.

Should You Pay Debt Collector or Original Creditor. YouTube

When a debt collector can contact you. A debt collector can only contact you at the following times: Monday through Saturday between 7:00 a.m. and 9:00 p.m. Sundays between 1:00 p.m. and 5:00 p.m. A debt collector can't contact you on holidays.

How to Remove Collections from Your Credit Report

The original creditor may try to collect their debts themselves or they may hire a debt collector. If the original creditor uses a different name when trying to collect their own debts, their actions fall under the FDCPA if the name used implies that a third-party is trying to collect the debt. Original creditors also may sell any past-due.

Debt Recalled By Original Creditor (2023 Explanation) Sensible Dollar

The original creditor is the party that has the legal right to collect payment for the debt. A debt collector, on the other hand, is usually a third party that the original creditor may hire to collect the debt payments. (In some cases, the original creditor may have an in-house collections department they rely on to collect on delinquent debts.)

How To Remove Medicredit From Credit Report Credit Having

These debt buyers pay the original creditor a percentage of the total debt collected. In most cases, debt buyers pay pennies on the dollar for the debt. At that point, the debt collector owns the debt. They can then proceed to collect the full amount, plus fees, court costs, and interest. Then, typically, the debt collector can go to court with.

/ Credit Tip If you can pay off a previous past

Hannah Locklear | December 07, 2023. Summary: You can pay off a debt to the original creditor if they haven't sold the account to a debt collection agency yet. There is a chance the debt may have been transferred to collections, but that doesn't mean it's too late to reach out to your creditor and settle the debt once and for all.

This calculator will help you determine how much you need to pay your

12 - 60 months. $10,000+ in unsecured debt & a hardship that's preventing you from paying your creditors. A nationwide service that can help you find a solution to reduce your debt payments by up to 50%. Request a free consultation with a trained debt relief specialist. Services include debt settlement, consolidation, credit counselling, debt.